Digital wallet access is available at Wells Fargo ATMs displaying the contactless symbol for Wells Fargo Debit andWells Fargo EasyPay® Cards in Wells Fargo-supported digital wallets. Availability may be affected by your mobile carrier's coverage area. Some ATMs within secure locations may require a card for entry. Before its acquisition by Wells Fargo and Company in 2008, Wachovia was the fourth-largest bank holding company in the United States, based on total assets.

Wachovia provided a broad range of banking, asset management, wealth management, and corporate and investment banking products and services. At its height, it was one of the largest providers of financial services in the United States, operating financial centers in 21 states and Washington, D.C., with locations from Connecticut to Florida and west to California. Wachovia provided global services through more than 40 offices around the world. ATM Access Codes are available for use at all Wells Fargo ATMs for Wells Fargo Debit and ATM Cards, andWells Fargo EasyPay® Cards using theWells Fargo Mobile® app. Digital wallet access is available at Wells Fargo ATMs for Wells Fargo Debit Cards and Wells Fargo EasyPay® Cards in Wells Fargo-supported digital wallets. Some ATMs within secure locations may require a physical card for entry.

Private banking refers to wealth management services provided by banks and other financial institutions to affluent customers. Finally, the contents of your safety deposit box are not covered by your bank's FDIC deposit insurance, which applies only to its deposited funds. Storing cash in a safety deposit box is actually riskier than putting that money into a savings account, and some banks actually prohibit the practice to discourage tax evasion. While most banks offer separate insurance plans that cover their boxes, these policies represent yet another added cost to the consumer. If you are planning to stash cash in your safe deposit box, consider opening a federally insured, interest-bearing account for that money instead. 3Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle.

For your protection, Zelle should only be used for sending money to friends, family, or others you know and trust. Sending money withZelle is similar to making a payment in cash. In a letter to Fed Chair Jerome Powell, the Massachusetts Democrat called on the central bank's board of governors to use its authority to separate Wells Fargo's banking unit from its financial services businesses.

She said the Fed could break up Wells Fargo by revoking its license to operate as a financial holding company. Mobile deposit is only available through the Wells Fargo Mobile® app. See Wells Fargo's Online Access Agreementfor other terms, conditions, and limitations.

After Steel took over, he insisted that Wachovia would stay independent. However, its stock price plunged 27 percent on September 26 due to the seizure of Washington Mutual the previous night. The large outflow of deposits attracted the attention of the Office of the Comptroller of the Currency, which regulates national banks. Federal regulators pressured Wachovia to put itself up for sale over the weekend.

Had Wachovia failed, it would have been a severe drain on the FDIC's insurance fund due to its size . Divorcing Wall Street-centric work — which can include managing investment funds and providing financial market sales and trading services — from the bank would ensure that Wells Fargo's everyday customers did not continue to suffer, Ms. Warren wrote. The Fed could accomplish this, she explained, by revoking Wells Fargo's financial holding company license — essentially making it impossible for the company to operate any nonbanking businesses. Add your Wells Fargo Debit orEasyPay® Cards to your digital wallet to easily access your accounts at a Wells Fargo ATM displaying the contactless symbol. Please note that Wells Fargo branch and call center staff do not have access to any additional information regarding if or when customers will receive a check or prepaid debit card.

Wells Fargo has processed all of the direct deposits we received from the IRS and U.S. If the payments are received for closed accounts or accounts with invalid account numbers, those stimulus payments are returned to the U.S. The IRS's Get My Payment tool will be updated to reflect direct deposit or mailed payment date. As business halted for the weekend, Wachovia was already in FDIC-brokered talks with Citigroup and Wells Fargo.

Wells Fargo initially emerged as the frontrunner to acquire the ailing Wachovia's banking operations, but backed out due to concerns over Wachovia's commercial loans. With no deal in place as September 28 dawned, regulators were concerned that Wachovia wouldn't have enough short-term funding to open for business the next day. In order to obtain enough liquidity to do business, banks usually depend on short-term loans to each other.

However, the markets had been so battered by a credit crisis related to the housing bubble that banks were skittish about making such loans. Under the circumstances, regulators feared that if customers pulled out more money, Wachovia wouldn't have enough liquidity to meet its obligations. People in larger cities also have the option of renting boxes with private vault companies. While such companies tend to charge much more than banks, their exclusive focus on security services means that you'll get better value from their safety deposit boxes.

Private vaults will often have better availability, larger box sizes, 24/7 access and a slew of enhanced security measures not found in a typical bank branch. Some private vaults also offer built-in insurance coverage for the contents of your deposit box, up to a certain amount. Since some banks reserve their boxes for existing account-holders, we recommend that you start your search at the bank you currently use for checking and savings accounts.

In one case, we found that BB&T Bank rents safety deposit boxes exclusively to its existing account customers. If you find that none of your nearby bank branches have any boxes, the next step is to use other bank websites to locate and call up branches close to you. Use theWells Fargo Mobile® app to request an ATM Access Code to access your accounts without your debit card at any Wells Fargo ATM. The bank has been dealing with a litany of regulatory issues since its phony-accounts scandal came to light in 2016. Employees at the bank previously opened millions of depository and credit card accounts without the consent of customers. In 2018, the situation continued to get worse when the Federal Reserve placed a $1.95 trillion asset cap on the bank that essentially prevented Wells Fargo from growing its balance sheet.

Simply insert your debit card and input your PIN to withdraw cash, make deposits and check your account balance. In most cases, deposited stimulus funds are available right away, up to $2500. Immediate availability of funds is subject to change at any time, without advance notice. Check your ATM receipt or mobile deposit confirmation screen to see when you will have access to your deposit.

If you did not file a tax return or have not given the IRS your direct deposit account information in the last two years, you may receive a US Treasury check. Golden West, which operated branches under the name World Savings Bank, was the second largest savings and loan in the United States. The business was a small savings and loan in the San Francisco Bay area when it was purchased in 1963 for $4 million by Herbert and Marion Sandler. In 2006, Golden West Financial was named the "Most Admired Company" in the mortgage services business by Fortune magazine. By the time Wachovia announced its acquisition, Golden West had over $125 billion in assets and 11,600 employees.

By October 2, 2006 Wachovia had closed the acquisition of Golden West Financial Corporation. In June 2005, Wachovia negotiated to purchase monoline credit card company MBNA. However, the deal fell through when Wachovia balked at MBNA's purchase price. Within a week of the deal's collapse, MBNA entered into an agreement to be purchased by Wachovia's chief rival, Bank of America.

Wachovia received $100 million as the result of an agreement Wachovia predecessor First Union made in 2000 when it sold its credit card portfolio to MBNA. This agreement required MBNA to pay this sum if it were ever sold to a competitor. In late 2005 Wachovia announced that it would end its relationship with MBNA and create its own credit card division so that the bank could issue its own Visa cards. Analysts, remembering the problems with the CoreStates acquisition, were concerned about First Union's ability to merge with another large company. Winston-Salem's citizens and politicians suffered a blow to their civic pride because the merged company would be based in Charlotte. The city of Winston-Salem was concerned both by job losses and the loss of stature from losing a major corporate headquarters.

First Union was concerned by the potential deposit attrition and customer loss in the city. First Union responded to these concerns by placing the wealth management and Carolinas-region headquarters in Winston-Salem. Wells Fargo is the country's fourth-largest bank, though its Wall Street presence — including investment banking and wealth management services — is much smaller than those of competitors like JPMorgan Chase and Bank of America. Its chief executive, Charles W. Scharf, has a Wall Street background and, since taking over two years ago, has tried to make Wells Fargo more profitable by steering it more toward Wall Street. The Fed has already taken drastic measures to try to force Wells Fargo to improve.

Since early 2018, the bank has been operating under an asset cap, which the Fed vowed to keep in place until the bank could prove it had overhauled its risk-management procedures and established better protections for its customers. But Ms. Warren said the bank was distracted from that goal, citing reports that Wells Fargo was trying to expand activities like putting together corporate mergers and other investment banking services. In addition, safety deposit boxes at most banks only permit access during bank hours. If you need to retrieve anything you've placed in your box in an emergency scenario, you won't be able to do so until the bank is open for business. As a result, items like passports, wills and powers of attorney may not be ideal for this kind of long-term storage. This site is designed to help people locate their bank's nearest branch locations, lobby hours, and online banking information.

This site is not run by, endorsed, or associated with Wells Fargo Bank in any way. Enter debit and credit cards into your digital wallet of choice so you can use your phone to pay, minimizing the touching of surfaces. Built into the Wells Fargo Mobile app,mobile deposit2 allows you to deposit your stimulus check, if you receive one by mail, from home at any time. Information about the closest Wells Fargo branches and locations can be found below, as well as the phone number of the customer service department, info about the business hours and more relevant details. Local time (8 p.m. in Alaska) are considered received on the same day.

Local time (8 p.m. in Alaska), on a bank holiday or weekend, the check deposit will be considered received the next business day. WFC, +1.28%shares rose 2% in pre-market trades on Friday despite a $250 million civil penalty from the Office of the Comptroller of the Currency for not meeting requirements of its 2018 action against the bank. The fine, which was announced late Thursday, had been anticipated after recent press reports and signals from the bank over the summer about regulatory friction.

Morgan Chase analyst Vivek Juneja described the fine as "moderate" but said the bank could face additional sanctions from Consumer Financial Protection Board. Nor did the OCC's order address issues surrounding auto insurance remediation, which could also result in additional sanctions, he said. "This consent order will result in more expenses, likely some delayed foreclosures, increased demands on management time, and greater board involvement," Juneja said. The OCC issued a cease and desist order against the bank, "based on the bank's failure to establish an effective home lending loss mitigation program." Wells Fargo's stock has risen 47% so far in 2021 while the S&P 500 SPX, +0.85%has gained 19.6%. By direct deposit into the bank account reflected or reported on your 2020 tax return.

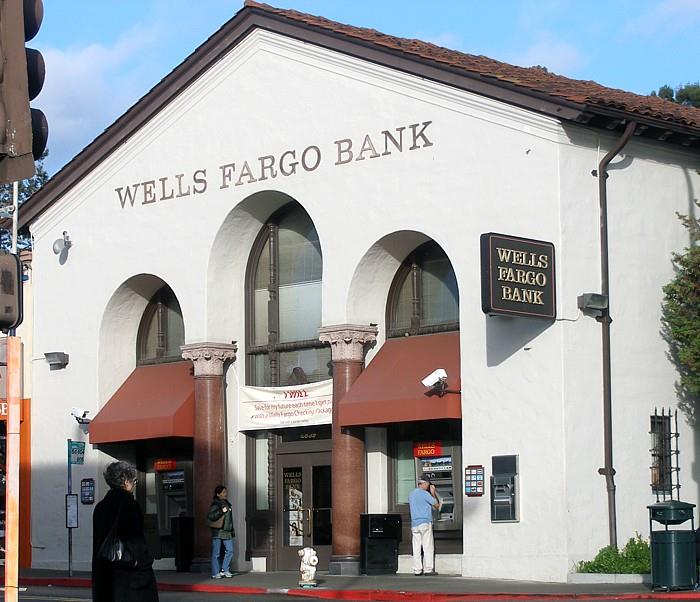

In April 2008, the Wall Street Journal reported that federal prosecutors had initiated a probe into Wachovia and other U.S. banks for aiding drug money laundering by Mexican and Colombian money-transfer companies, also known as casas de cambio. These companies help Mexican immigrants in the United States send remittances back to family in Mexico, but it is widely known that they also present a significant money-laundering risk. However, not only is it a "lucrative industry" that is able to charge high fees, but Wachovia also viewed it as a way to gain a foothold in the Hispanic banking market. The combined company retained the Wells Fargo name, and was based in San Francisco. However, Charlotte remained as the headquarters for the combined company's East Coast banking operations, and Wachovia Securities remained in Charlotte.

Three members of the Wachovia board joined the Wells Fargo board. The merger created the largest branch network in the United States. Between 2001 and 2006, Wachovia bought several other financial services companies in an attempt to become a national bank and comprehensive financial services company. Another complication concerned each bank's credit card division.

In April 2001, Wachovia had agreed to sell its $8 billion credit card portfolio to Bank One. The cards, which would have still been branded as Wachovia, would have been issued through Bank One's First USA division. First Union had sold its credit card portfolio to MBNA in August 2000. After entering into negotiations, the new Wachovia agreed to buy back its portfolio from Bank One in September 2001 and resell it to MBNA. The idea of revoking the bank's financial holding company license was first proposed two years ago by Jeremy Kress, an assistant professor of business law at the University of Michigan's Ross School of Business. In a letter to the Federal Reserve chair, Jerome H. Powell, on Monday, Ms. Warren asked the Fed to force the financial giant to break off its core banking activities, like offering checking and savings accounts and loans, from its other financial services.

A deposit account agreement or schedule of fees from your bank's website will often include the relevant information. Having an account at the same bank with your safety deposit box also saves you money on the invoicing fee, a common annual charge on box rentals. Of the banks we surveyed, only Chase and Regions confirmed that their prices for safety deposit boxes were the same at all branches. Each of the other banks noted that prices are determined on a local basis by individual branches. And finally, not every location will have the same safety deposit box services available.

Most community banks don't offer private banking services at the same level as larger banks, Beverage said. Private banking is provided in Oklahoma by some of the larger players in banking such as Bank of Oklahoma and Bank of America and by trust companies and other financial institutions. Enroll in Wells Fargo Online® and download the Wells Fargo Mobile® app. Use the Wells Fargo Mobile®2 app's built-in check deposit feature and access other digital banking options. For most customers, Wells Fargo has increased daily and rolling 30-day mobile deposit limits and ATM withdrawal limits.

Customers will also have access to up to $2,500 immediately for deposited stimulus checks, including those submitted through mobile deposit (subject to a customer's earlier account activity and the customer's daily and 30-day mobile deposit limits). Also, most customers are able withdraw up to $710 from the ATM daily (subject to a customer's earlier ATM withdrawal activity). A dental laboratory technician visited Wells Fargo's bank branch in Mesa, Arizona, July 8, but not for its financial services, as it had closed for the day. Only select devices are eligible to enable sign-on with facial recognition.

If you have family members who look like you, we recommend using your username and password instead of facial recognition to sign on. If you store multiple fingerprints on your device, including those of additional persons, those persons will also be able to access your Wells Fargo Mobile® app via fingerprint when fingerprint is enabled. The U.S. senator wrote to Fed Chair Jerome Powell to demand that Wells Fargo ditch its investment bank so management could focus solely on fixing the problems in its main street business.

The latter is the division that's led to more than $5 billion in fines and settlements over the past five years. However, the bank issued a press release stating that it is making efforts to change its practices and ensures it meets the demands of the financial regulators. Wells Fargo maintained that it has introduced some changes over the past five years and will continue to improve its services. She stated that the Fed could break up the bank by revoking its license to provide services as a financial holding company.

Warren added that the Federal Reserve has the power to put the interest of the consumers first and must exercise that power. Then in February, Bloomberg reported that the Federal Reserve had approved the bank's proposal for overhauling its risk-management and governance structure, which is seen as a critical step toward getting the asset cap removed. Although Wells Fargo is currently operating under roughly 10 consent orders from various banking regulators, the asset cap is seen as the most prohibitive for the stock. Check with your service provider for details of specific fees and charges.